How the CBAM is going to transform steel imports from the EU

CBAM is the carbon border adjustment mechanism. It was designed as a tool to combat climate change.

The mechanism should lead relevant sectors to modernise and thus reduce their carbon footprint.

One of the central pillars of the Fit-for-55 agenda, CBAM is the EU’s reference tool for combating carbon leakage.

Steel is an important part of modern society. It provides the means for the infrastructure that is needed to minimise the effects of natural disasters. As cities expand to keep up with population growth, they will need large amounts of steel.

The manufacture of steel involves a lot of energy consumption. Which means that it also results in a significant amount of carbon emissions.

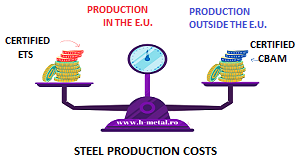

The CBAM aims to prevent the relocation of production to non-EU countries or the increase in imports of products that generate high carbon dioxide emissions.

What is the timeline for the launch of CBAM (carbon border adjustment mechanism) fees?

A simplified version of the CBAM will start operating from October 1, 2023. During a transition period, it will oblige importers to collect/report data related to carbon emissions.

All companies that import high-carbon products from non-EU countries into the EU will most likely be affected.

They must register as a declarant for CBAM purposes. From October 2023, importers/declarers of these goods in the EU will have to comply with certain obligations under the CBAM regulation.

Starting with 2026, importers of electricity, aluminum, cement, fertilizers, hydrogen, iron and steel to the E.U. will have to pay this tax.

Importers will have to declare annually the quantity of goods and the amount of emissions embodied in the goods they imported into the EU in the previous year. Also, to hand over the corresponding amount of CBAM certificates.

Prior to adoption, the implementing regulation was subject to public consultation. Subsequently, approved by the CBAM Committee, composed of representatives of EU Member States.

<< Inapoi